How the depletion of neodymium could affect your business

The supply of neodymium, a rare earth metal that is used to manufacture the majority of magnets and tweeters in speakers, is rapidly depleting. Dimi Kyriakou explains how this will impact the production and price of loudspeakers in the custom installation industry.

While the basic design of the loudspeaker hasn’t changed much in the past 50 years, the materials used to form the heart of the product have improved dramatically. Take magnets as an example. In the early days, alnico magnets were the material of choice until a shortage in supply and increased costs precipitated a shift to ceramic. Other conventional speakers were built with iron-ferrite magnets that offered good performance, but were much heavier to work with.

The holy grail of magnets was then found in neodymium, and manufacturers have since reaped the benefits of using this rare earth metal in the production of their loudspeakers. Due to its lightweight properties, neodymium often allows loudspeaker motors to be as little as half the weight of comparable ceramic magnet motors – and when it comes to in-wall and in-ceiling speakers, there’s no doubt that a lighter weight is of paramount importance. On top of this, neodymium is a strong material that is also efficient in its role within a loudspeaker.

ADVERTISEMENT

In the 1990s, China began mining the materials used to make neodymium magnets and, as a result, was able to offer the rare earth metal at a drastically reduced price in order to meet the growing interest in lighter weight speakers. Due to its aggressive pricing, China became the predominant supplier of neodymium to the world.

But, of course, all good things must come to an end (particularly in the mining industry). The use of neodymium has since skyrocketed not only in loudspeakers but also in other consumer electronics, military applications and more recently, green energy products. For example, the rare earth metal is currently being used in the production of wind turbines.

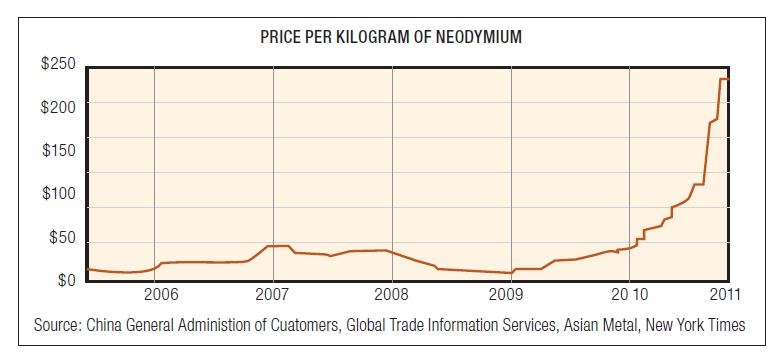

Given that China is actively involved in these areas, there is no doubt that it will need the remaining neodymium resources to manufacture its own products. In turn, it has reduced the amount of neodymium exported to other countries – causing prices to soar.

Researchers are now working on new types of magnets that are stronger, lighter and use smaller amounts of rare earth metals than standard magnets. However, it’s not clear if these new options will get to market before the demand for neodymium exceeds the supply (which, according to the US Department of Energy, could occur in 2020).

So, what does all of this mean for loudspeaker manufacturers that currently use neodymium in their products and, ultimately, the custom installer and consumer at the end of the food chain?

According to CEAD AV technical and integrations manager Nick Graham, this issue will affect members of the custom installation industry right across the board. In CEAD’s case, neodymium drivers are a popular ingredient in five of the company’s loudspeaker drivers.

“The main reason for this is due to the size of the speaker and the application. Weight is a fairly big concern and neodymium does play a big part in that,” he says. “

For our Segretto invisible in-wall speakers, a lightweight product is crucial given its position in the plaster and the way they are supported in the wall. The in-ceiling speakers in our BMR range also use neodymium for the same reason.

“The second major benefit to using neodymium is the size of the driver. You need far less neodymium compared to a ferrite magnet to get the same result. And because you’ve got less metal, you don’t have as much heat trapped within the speaker and it can dissipate a lot easier. So it’s a way of getting the heat out of those drivers as well.”

US-based Sonance is in a similar position, as almost every speaker that the company manufactures contains some neodymium.

“There is about seven to 10 grams of neodymium in a typical pair of our speakers. It is used primarily in the tweeter as well as to attach the grilles in our Visual Performance series,” Sonance chief speaker designer Todd Ryan says.

“While there are no sonic benefits to using neodymium, its advantage is its increased strength for its size versus a traditional ferrite magnet. The increased strength allows for the use of much smaller magnets, which makes designing things like pivoting tweeters, shallow woofers and flangeless grilles possible in speakers.”

Currently manufacturers are putting time and money into the R&D process to determine if there is a suitable alternative to take the place of neodymium in loudspeakers – but coming up with new magnet materials isn’t easy.

According to GE Global Research, developers are now testing nanocomposite magnet materials. These are made up of nanoparticles of the metals that are found in today’s magnetic alloys (for instance, neodymium-based nanoparticles mixed with iron-based nanoparticles). The advantage of nanocomposite magnets is twofold: they promise to be stronger than other magnets of a similar weight, and they should use less rare-earth metals.

In the meantime, speaker manufacturers are looking into a solution based on the traditional ferrite material.

“All of our existing stock currently uses neodymium. What we have on hand at the moment won’t last forever, so we do need to look at using alternatives down the track,” Nick explains.

“We’re starting to look at going back to the ferrite drivers. We would basically have to re-engineer the speakers, much like every other manufacturer in the world, to get that strength that was originally created by the neodymium.

“It means starting off with a much more bulky magnet, and due to that the speaker will be heavier. The R&D process will be about trying to keep the weight down and trying to dissipate the heat that is produced by the drivers themselves.”

While carbon filaments could also be an option for the future, for now Sonance is also testing a ferrite alternative.

“I believe the neodymium price increases that were implemented during 2011 were a move by China to force other countries that were mining rare earth materials in the past to start again,” Todd says.

“I am not sure that carbon filaments can be magnetised to the strength seen in rare earth magnets, so Sonance is looking to use ferrite magnets more extensively in the future.”

And then there’s the issue of existing stock that already features neodymium in the loudspeakers – will these prices also have to increase or can manufacturers afford to hold off on a price jump?

“When we changeover to new stock, we will probably have to use ferrite drivers at that point anyway. Hopefully there will be no change in price as we’re trying to avoid pumping up the cost of speakers with neodymium drivers,” Nick says.

As Todd explains, the price of custom installation products has risen consistently since the inception of the industry, and a price increase for the use of neodymium in speakers would generally represent a 5-10% price increase at retail.

“The dealer price would go up correspondingly so in the end a consumer would be paying for the use of neodymium to get the features they desire. Eventually the price for all products that use neodymium will have to increase. That increase will affect almost every electronic product made, including mobile phones, laptops, automobiles and of course speakers.”

As you would know, installers struggle to make money from speakers already, so if the profit margin in these products continues to lessen, what will this mean for the industry? There’s no doubt that this neodymium issue will have an impact on those working within the custom installation sector… but at the end of the day, a consumer should expect to get what they pay for.

“You will have consumers that care about the price to a degree, but they know what sound they’re after and they will be happy to pay for that. You’ve also got the other side of clients who don’t care what they listen to; they have a budget and they will work within that,” Nick explains.

“If speaker pricing has to go up due to the price of neodymium, I think that all consumers will have to just accept that.”

-

ADVERTISEMENT

-

ADVERTISEMENT

-

ADVERTISEMENT

-

ADVERTISEMENT